Lower sales of new vehicles and geopolitical risks in the form of Chinese competition or upcoming events in the US are the topics that dominated this year’s CEE Automotive Supply Chain 2024 conference. Representatives of the automotive industry discussed not only the challenges but also the opportunities that this complex time brings. The largest meeting of automotive suppliers in the Czech Republic and Slovakia took place for the seventh time this year.

The seventh year of the CEE Automotive Supply Chain conference, which took place on 13-14 November in Žilina, Slovakia, attracted more than 340 experts not only from the automotive sector, but also a number of analysts and former MEPs. Together, they reflected on how to respond to changing market conditions, the transition to electromobility and geopolitical changes that are shaping the future of the European automotive industry.

Crisis, chance and record production growth

Alexander Matušek, President of the Association of the Automotive Industry of the Slovak Republic, drew attention to the dramatic decline in sales of new vehicles on the European market and described this situation as a “crisis”, which, however, also brings new opportunities. According to him, Slovak automakers are benefiting from new models that will ensure production for the next two to three years, but the future challenge remains obtaining additional products.

Petr Novák, member of the board of directors of the Automotive Industry Association and COO of JTEKT Central Europe, pointed to geopolitical risks and legislative challenges, while at the same time highlighting the record growth of Czech production, which should reach 1.4 million vehicles in 2024. These numbers make the Czech Republic a “European exception”, he said.

Petr Novák, member of the board of the Association of the Automotive Industry and COO of JTEKT Central Europe, highlighted the record growth of Czech production, which should reach 1.4 million vehicles in 2024. | Photo: Ján Brunčák

Geopolitical challenges and the path to sustainable competitiveness

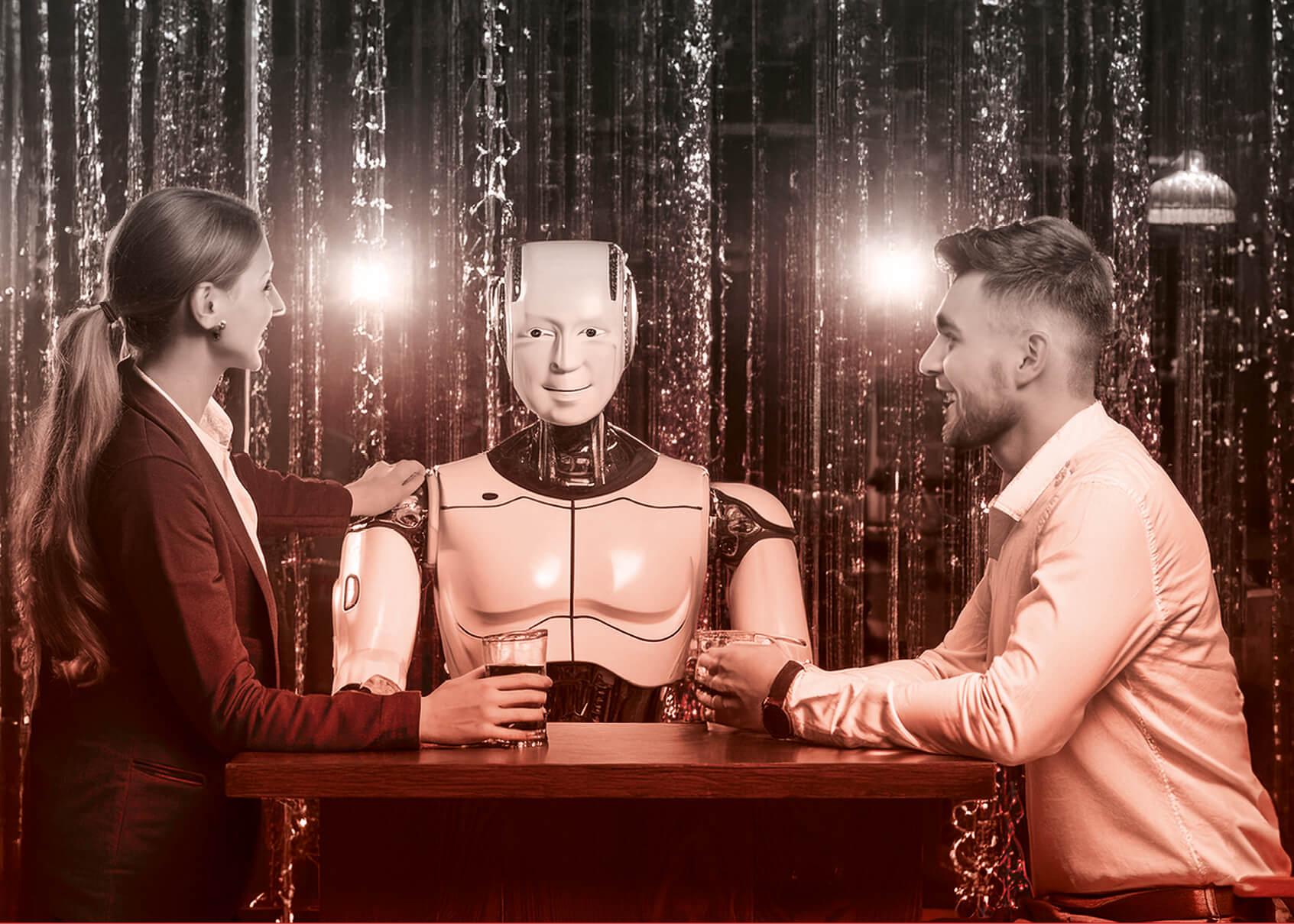

Another discussion panel focused on strategic issues that shape the future of the automotive industry in Europe. The key topics were geopolitical changes, the new composition of the European Parliament and the influence of the US presidential election on the global market. The main discussion revolved around the competitiveness of the European automotive sector, especially in relation to the transition to electromobility and ensuring stable supplies of critical raw materials, especially for battery production.

According to the former vice-president of the European Parliament, Dita Charanzová, it is essential that the European Union supports innovation and investment. This goal is also reflected in the Action Plan for the automotive industry presented in Mario Draghi’s analysis, which contains specific measures for automakers. The Director General of the Association of European Automobile Manufacturers (ACEA) Sigrid de Vries appealed to take advantage of this opportunity: “Implementation of these measures is crucial, but at the same time we need to reassess the goals with regard to the real possibilities of the automotive sector.”

The panelists also discussed the transition to electromobility, with calls to reconsider the date for the end of internal combustion engines. “It is important to balance ecological ambitions with the needs of producers and consumers,” said Ivan Štefanec, a former member of the European Parliament.

Support for innovation and investment by the European Union is absolutely essential, the panelists agreed. | Photo: Ján Brunčák

China and opportunities for suppliers

A panel discussion of Tier1 suppliers revealed diversified strategies to cope with the current changes in the automotive industry. Dušan Variant from Adient, a manufacturer of car seats, described China as an opportunity rather than a problem. Adient focuses on supporting Chinese customers by localizing production, thereby securing new orders.

Vladimír Toman from Miba Sinter Slovakia, a manufacturer of components for internal combustion engines, emphasized the need to focus on the development of technologically advanced products that will ensure global competitiveness in the electromobility segment as well.

Petr Novák from JTEKT Central Europe pointed out that suppliers are feeling the crisis even more than final producers. Inflation, rising energy and labor costs, or uncertainty about future regulatory requirements are forcing companies to take drastic measures, such as closing European plants. “In order to survive, we must innovate. In our case, for example, we are developing a steering system “steer by wire”, which is a precursor to autonomous driving,” he said.

Lukáš Rosůlek from Schaeffler, on the other hand, is more optimistic about the current situation. He does not consider it a crisis, but an opportunity for adaptation and improvement. However, he warned against unnecessarily complicating the situation in an effort to achieve ecological goals.

The panelists agreed that China remains a key player in the global market. Despite different approaches to the country, it is essential for European suppliers to find a form of cooperation that will allow them to take advantage of China’s potential while maintaining competitiveness.

Lukáš Rosůlek, member of the AutoSAP board and director of Schaeffler Czech Republic, does not see the current situation as a crisis, but an opportunity for adaptation and improvement. | Photo: Ján Brunčák

The future of Slovak car companies and the European battery industry

Representatives of Kia Slovakia presented a strategy with the aim of significantly reducing CO₂ emissions and fuel consumption. “Kia Slovakia strives to achieve carbon neutrality before the EU regulations require it,” Roman Kraĺovanský, director of production, confirmed in his speech. His presentation also focused on the development of a smaller and affordable electric model planned for 2026 and the challenges of battery technologies and charging infrastructure. At the same time, he emphasized the need for flexibility in production and the continuation of the development of various types of batteries.

Volvo Cars Supply Chain representative, manager Veronika Fečová, presented the new production plant in Košice, which will produce up to 250,000 vehicles per year and create 1,500 jobs per shift. She emphasized the brand’s commitment to sustainability and encouraged suppliers to register on the company’s portal, emphasizing the requirement for environmentally responsible sourcing.

The European battery industry was another key topic. The panelists drew attention to Europe’s dependence on Chinese technology, which affects up to 80 percent of the production of battery cells. European manufacturers are faced with the need to rethink their investment strategies. Key tasks include analyzing regulatory barriers and developing strategies to support more affordable electric vehicles and supply chain diversification. In addition to the need for deregulation, speakers also stressed the need for a realistic trade policy and strengthening cooperation with Africa to make European battery production more competitive.

More than 340 experts from the automotive and related sectors participated in the two-day CEE Automotive Supply Chain 2024 event in Žilina, Slovakia. | Photo: Ján Brunčák

B2B meetings key to new business opportunities

In the morning and afternoon program of the second day of CEE Automotive Supply Chain 2024, traditional and very popular organized B2B meetings took place, of which a total of 435 took place. The next edition of CEE Automotive Supply Chain, this time with serial number 8, will take place in 2025 in the first week of November in the Czech Republic Olomouc.

A total of 435 organized B2B meetings took place at CEE Automotive Supply Chain 2024 | Photo: Ján Brunčák

Fotogalerie

Contact

Next articles and interviews

Next articles and interviews

+ Show