Electric cars have the potential to significantly reduce greenhouse gas emissions. But there are also analyses that battery production for these cars may soon face shortages of critical raw materials. What are the origins of lithium, cobalt, nickel, manganese and other raw materials and what does this mean for battery manufacturers? Vladimír Rybecký has written an extensive text about this for Czech Car Industry.

The end of last year and the beginning of this year have been marked by two landmark decisions for the automotive industry in the European Union: a ban on the sale of cars with CO2-emitting powertrains from 2035 was proposed and approved by the European Parliament in February this year, and a draft Euro 7/VII emissions standard was published. Somewhat on the sidelines was a third regulation that will have a major impact on the future development of mobility in Europe, namely new EU rules for more sustainable and ethical batteries.

Breakthrough law for batteries

MEPs in the European Parliament have debated a ground-breaking law to address the environmental, ethical and social problems associated with battery production. The newly agreed rules cover their entire life cycle – from raw material extraction to industrial production to end-of-life disposal, with a high level of recycling required.

The introduction to the proposal states that at least 30 million electric vehicles will be on EU roads by 2030. The EU projects that global demand for batteries will increase 14 times by 2030, with Europe accounting for 17% of this demand. This dramatic growth will be driven not only by the needs of electric mobility, but also by the development of the digital economy and renewable energy sources.

In view of their growing use, MEPs have also called for a new category of batteries for so-called Light Means of Transport (LMT), such as electric bikes or electric scooters. The new category will sit alongside the existing classes of portable, automotive and industrial batteries.

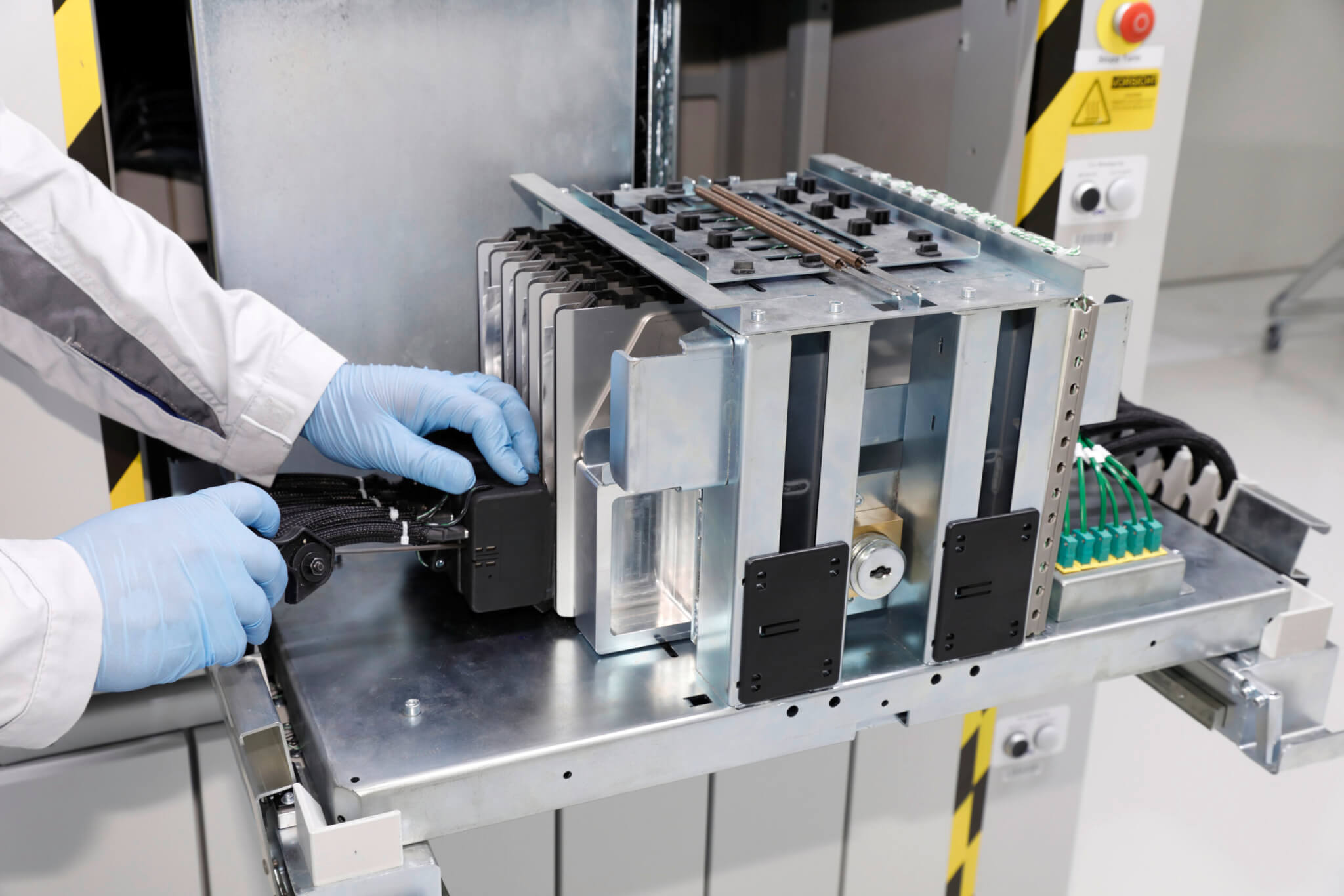

Battery cell production at the Volkswagen Group plant in Salzgitter. | Photo: Volkswagen

Controlling the carbon footprint and ethical standards

Batteries used in the EU will have to be labelled to reflect their carbon footprint to make their environmental impact more transparent. This will be mandatory not only for electric vehicle (BEV) batteries, but also for light duty vehicles (LDVs) and rechargeable industrial energy storage systems with a capacity of over 2 kWh. Manufacturers wishing to sell in Europe will have to report the entire carbon footprint of the product, from extraction to production to recycling, from July 2024. This data will then be used to set a maximum CO2 limit, which will apply from July 2027. This is to ensure that only clean energy is used in production instead of fossil fuels.

Influential NGOs such as Transport & Environment (the European Federation for Transport and Environment, which promotes sustainable transport in Europe) are calling for the new rules to rule out greenwashing, whereby manufacturers would only publish formal proof of energy origin, but would have to clearly demonstrate that all the energy they use is genuinely renewable.

MEPs are calling for an obligation for battery manufacturers to tackle human rights abuses and ensure that the raw materials used are ethically sourced. They must comply with the requirements relating to the social and environmental risks associated with the extraction, processing and trading of raw materials and secondary resources. The law will require producers to identify and address a wide range of issues from water pollution to community rights.

Currently, the world’s largest producers of batteries for electric vehicles are China, Japan and South Korea. The law is intended to ensure that production from new European cell and whole battery manufacturing plants cannot be undercut by the price of imported batteries produced using coal-generated electricity, with little regard for human and workers’ rights.

In this context, the investment needed to create a higher recycling rate should be accelerated. Under the new rules, a prescribed amount of recycled raw materials must be reused in new batteries. From 2027, manufacturers will have to recover 90 per cent of used nickel and cobalt, rising to 95 per cent in 2031. Lithium is required to increase from 50 percent in 2027 to 80 percent in 2031.

All of this together is expected to help create more new jobs in Europe. “We have set up the regulation of batteries to ensure a level playing field so that all batteries placed on the EU market, regardless of their origin, will meet the same strict sustainability and durability requirements,” explained European Commission Vice-President Maroš Šefčovič, who has long been the main driver of the battery regulations, as well as promoting battery production in the EU.

Impact of mining on the ecological and social system

The implementation of the EU law on batteries is of course to be welcomed. The extraction of raw materials can never be completely sustainable, so the risks involved can only be minimised. As the analysis by the German Society for Sustainable Mobility and Energy Resources NOW, citing the work of L.J. Sonter, the Öko-Institut and ELAW, points out, the impact of raw material extraction is both global, through greenhouse gas emissions, and local, through emissions of other substances.

In addition to the environmental impacts and their negative consequences on human life, there are also political problems. Inhabitants of mining areas are often confronted with displacement (often under duress) and restrictions on cultural and traditional values. Age limits, minimum wage levels, working hours and occupational health and safety policies are often not respected for workers.

Cobalt mining in the Democratic Republic of Congo is a frightening example. Human rights organisations such as Amnesty International have long drawn attention to humanitarian problems, the use of child labour, human rights violations and environmental pollution. At the same time, more than 60 per cent of the cobalt used in batteries for electric cars and LMTs, but also for small appliances, computers, telephones and other devices and equipment, comes from here.

Copper mining in Uzbekistan. | Photo: PR newswire

High ambition, low availability

Electric cars can use different types of batteries. Currently, the predominant type is lithium-ion. The materials required for their manufacture can vary depending on the chemical composition of the cathode, with lithium, cobalt, nickel and manganese being the key materials. Graphite is widely used as the anode.

An assessment of EV battery supply chain vulnerability using a methodology developed by Energy Monitor GlobalData shows that the countries with the largest EV sales are also the countries with the highest supply chain vulnerability, with China being the exception. According to GlobalData’s analysis, China had more than 70 percent of global EV battery production capacity in 2021. According to this analysis, Germany and the United States have the second and third largest EV sales, but are heavily dependent on imports of raw materials for batteries.

“Today’s data shows a looming mismatch between the strengthening of the world’s climate ambitions and the availability of the critical minerals needed to realise those ambitions. If not addressed urgently, these potential vulnerabilities could slow and make global progress towards a clean energy future slower and more expensive, and thus complicate international efforts to tackle climate change,” warned Fatih Birol, Executive Director of the International Energy Agency (IEA), in a special report on the role of critical minerals in the clean energy transition.

The total demand for critical minerals for electric vehicles in 2020 was 0.4 million tonnes. Based on its Sustainable Development Scenario, the IEA predicts that this demand will increase almost 30 times to 11.8 million tonnes in 2050. In a separate report, the IEA states that, based on today’s supply and investment plans, this demand for minerals is unlikely to be met. In the medium to long term, the IEA predicts that demand will exceed supply from existing mining projects.

New projects needed

Investment in new projects will therefore be necessary to meet the growth in demand. This, however, requires the opening of new mines that produce recoverable minerals. According to the IEA, it takes an average of 16.5 years for a mining project to move from the discovery phase to the start of operations. At the same time, growing environmental concerns and a lack of local support can delay or halt such projects, which is also happening in many cases, particularly in Europe.

A problem for the future supply chain is that the key minerals needed for EVs are only mined in a few countries. More than half of the supply comes from the top three producers – in 2020, Australia accounted for 48 per cent of global lithium production; for graphite, China is the world’s main supplier, accounting for almost 79 per cent of global production; and the Democratic Republic of Congo supplied 69 per cent of global cobalt production.

At the end of 2020, the EU listed lithium as a critical raw material and the United States did the same. European Commission Vice-President Maroš Šefčovič said at the time that Europe would need up to 18 times more lithium for electric car batteries and energy storage by 2030 and up to 60 times more by 2050. However, the EU currently meets only one percent of demand. “We cannot allow our current dependence on fossil fuels to be replaced by dependence on critical raw materials. We will therefore build a strong alliance to move together from high dependence to diversified, sustainable and socially responsible supply, circulation and innovation,” said Šefčovič.

The key metal of today: lithium. | Photo: Presseportal/Bokelao

Resources are a global problem

In an analysis for the Union of Concerned Scientists, a non-profit organisation founded more than 50 years ago by scientists and students at the Massachusetts Institute of Technology, Jessica Dunn argues that the availability of critical raw materials cannot be a major obstacle to the progressive development of electromobility. However, a shortage of raw materials on the market could lead to dramatic price increases for individual materials – expected especially for lithium and cobalt, but also for graphite. It also warns of problems with the exploitation of certain deposits due to the difficult political situation in various regions of the world.

Transport & Environment forecasts that more than 50 % of European lithium demand could come from European projects by 2030, relying on emission-free lithium mining in conjunction with geothermal energy. Several such projects, notably Vulcan Energy Resources in Germany, look very promising, but we are still waiting for their practical implementation.

In addition to the above-mentioned critical materials needed for electro-mobility, copper is indispensable not only for the conductors in vehicles but also for the necessary infrastructure. In addition, other electrified modes of transport, especially rail, also require it. Here, resources are divided between several countries, but more than half of the ores are mined in Chile, Peru and China, with 56 per cent of the metal being processed in China, according to the IEA.

Are recycled materials the solution?

In an analysis for the Union of Concerned Scientists, Jessica Dunn argues that recycling can significantly reduce the need for new mining and is therefore an essential strategy for sustainable, safe and affordable transport electrification. The environmental impact of using recycled materials is much less than that of newly mined materials. Recycling can also reduce costs. Dunn reports that in 2050, recycling can meet approximately 45-52 percent of cobalt needs, 40-46 percent of nickel needs, and 22-27 percent of lithium demand for electromobility.

Currently, however, recycling technologies are not cost-effective due to the small volume of production. Even in the short term, recycled materials will represent a small quantity, but this will change as battery discards increase. Recycling revenues will then increase significantly as the market value of materials increases and recycling can become a very profitable business. Moreover, it will also contribute to domestic production in Europe.

However, a study by the Locomotion project, Group for Energy, Economics and System Dynamics of the University of Valladolid (GEEDS-UVa) points to the limits of recycling, noting that achieving a high target level at the end of battery life does not necessarily mean that a high percentage of materials will come from recycled sources. This is because there is a constant increase in demand for new materials, and there is always a delay in the use of recycled materials due to the large amount of raw materials that will still be used in service. “Recycling is a useful way to reduce waste and other negative environmental impacts, but it is not as effective as it could be because materials are often used for long periods of time before they are recycled. This is exacerbated by the fact that the current economic system is more focused on growth than sustainability,” warns Locomotion researcher Iñigo Capellán-Pérez.

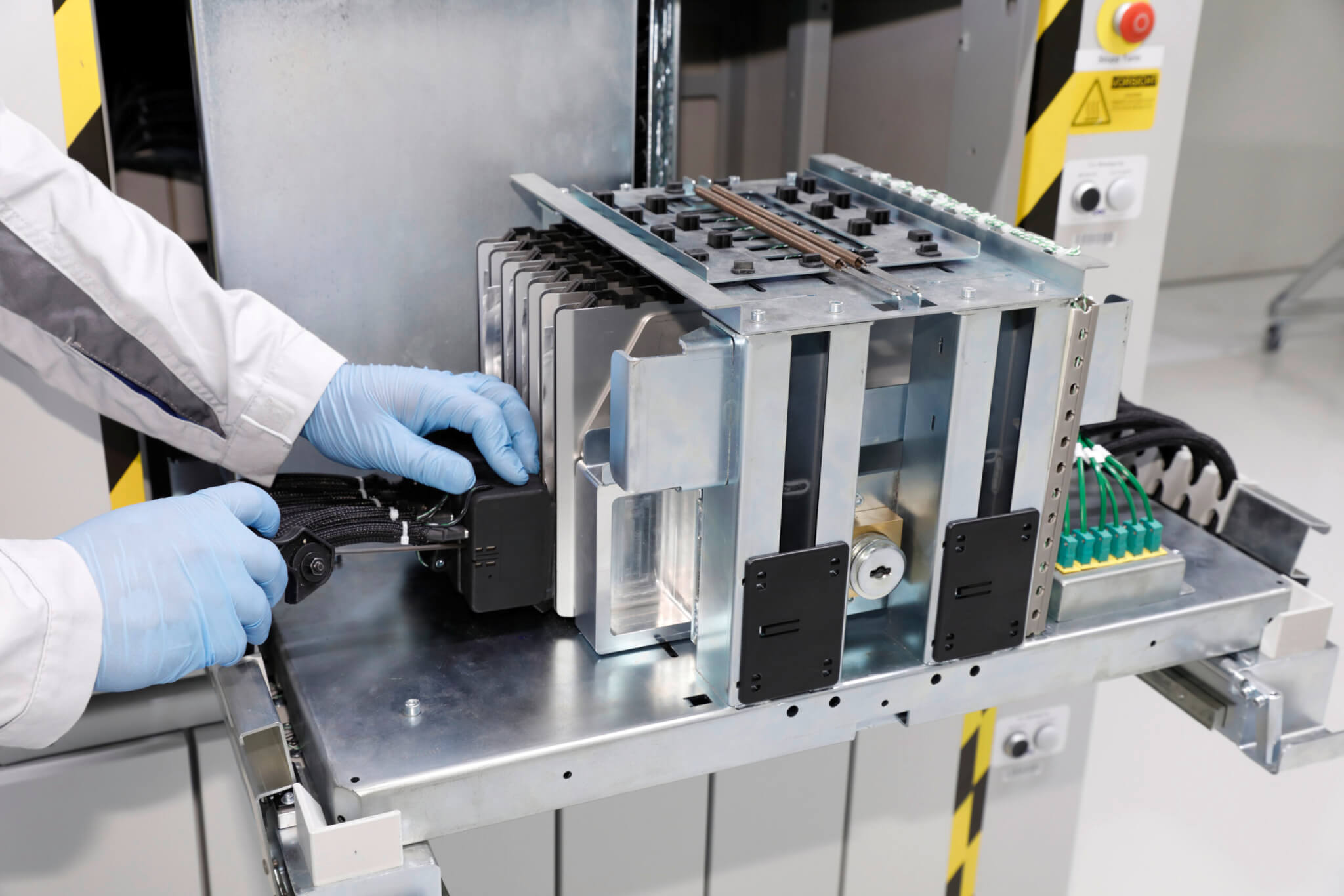

Transportation of batteries for recycling at the test facility in Salzgitter. | Photo: Volkswagen

Degression strategies

The new study, published by Locomotion, compared the effectiveness of different strategies for decarbonising the global transport sector by 2050. By testing different scenarios – i.e. expected trends in electromobility with different rates of expansion, the use of LMTs, and a degression strategy – it found that only a degression scenario, i.e. a halt in growth that would reduce transport and mobility needs in general, would be feasible given the available material resources.

Degressive growth is the scenario that puts the least pressure on resources, but would require the introduction of political, economic and cultural changes worldwide. However, of all the scenarios simulated, it is the only one that is consistent with the reduction in greenhouse gas emissions required by global international targets, while putting less pressure on resource needs.

Six materials (copper, cobalt, lithium, manganese, nickel and graphite) out of the seven (excluding aluminium) analysed in the Locomotion study exceed current stock levels in at least one of the scenarios, with the exception of the degradation scenario. Conversely, the high rate of development of electromobility will put more pressure on material resources, while demand from other sectors of the economy will also develop similarly.

“The degression scenario is the only one that both meets the decarbonisation objective required by global international greenhouse gas reduction targets and is broadly compatible with current material options. However, even in this case, current reserves of copper, cobalt, manganese and nickel would be exhausted by 2050. Further research is therefore needed to explore the development of a degrowth scenario in global transport and other relevant material-intensive sectors that is fully compatible with available material resources,” said GEEDS-UVa researcher Iñigo Capellán-Pérez.

In terms of energy analysis, the Locomotion study recommends prioritising transport modes using electric vehicles with higher energy returns, such as shared and public transport.

Finding the right path according to de Meo

Renault Group chief executive Luca de Meo recently told AutoBest journalists: “The real problem of electro-mobility in the next 10 to 15 years will be the lack of raw materials. Therefore, instead of producing cars with a huge range per charge, it will be more important to find the right balance between customer needs and battery size. Nobody, apart from truck drivers, normally drives more than 300 to 350 kilometres without stopping. Therefore, from an environmental point of view, it is also right to use the smallest possible batteries in electric vehicles. The better the infrastructure, the smaller the batteries we will need, and the smaller the batteries we use, the cheaper and more accessible electric cars will be and the easier they will be to recycle. At Renault, we are working hard on battery refurbishment and material recycling. In fact, with the exception of Tesla, we are the first manufacturer to start returning batteries, because we started making electric cars before anyone else.”

The European Union’s efforts to provide the most environmentally friendly and ethical batteries for electric vehicles can only be welcomed. However, the question is whether it is realistic to meet all these requirements so that not only cars with internal combustion engines will be out of the picture in 2027 as a result of the Euro 7/VII emissions standard, but also electric cars, because batteries meeting EU legislation will not be available for them. Yet it is not in the hands of the car industry to create the necessary conditions.

Contact

Next articles and interviews

Next articles and interviews

+ Show